WASHINGTON D.C., DC — The U.S. Senate unanimously passed bipartisan legislation to provide tax relief to the children of military members killed in service to their country.

The legislation, which was cosponsored by Sens. Tim Kaine and Mark Warner, corrects one of the many unintended consequences of the Tax Cuts and Jobs Act of 2017. The tax bill treats military and VA survivor benefits as trusts or estates, subjecting the benefits of many military families to a much higher tax rate.

The Gold Star Family Tax Relief Act effectively fixes this error by treating any military and VA survivor benefits as earned income, rather than at the trust or parent tax rate.

View the full bill below:

Under current law, spouses of deceased service members are eligible to receive two different survivor benefits – the Department of Veterans Affairs' Dependency and Indemnity Compensation, as well as the Department of Defense (DOD) Survivor Benefits Plan. However, surviving spouses are not currently able to receive both benefits simultaneously in full, and many of these spouses choose to sign the taxable DOD benefit over to their children.

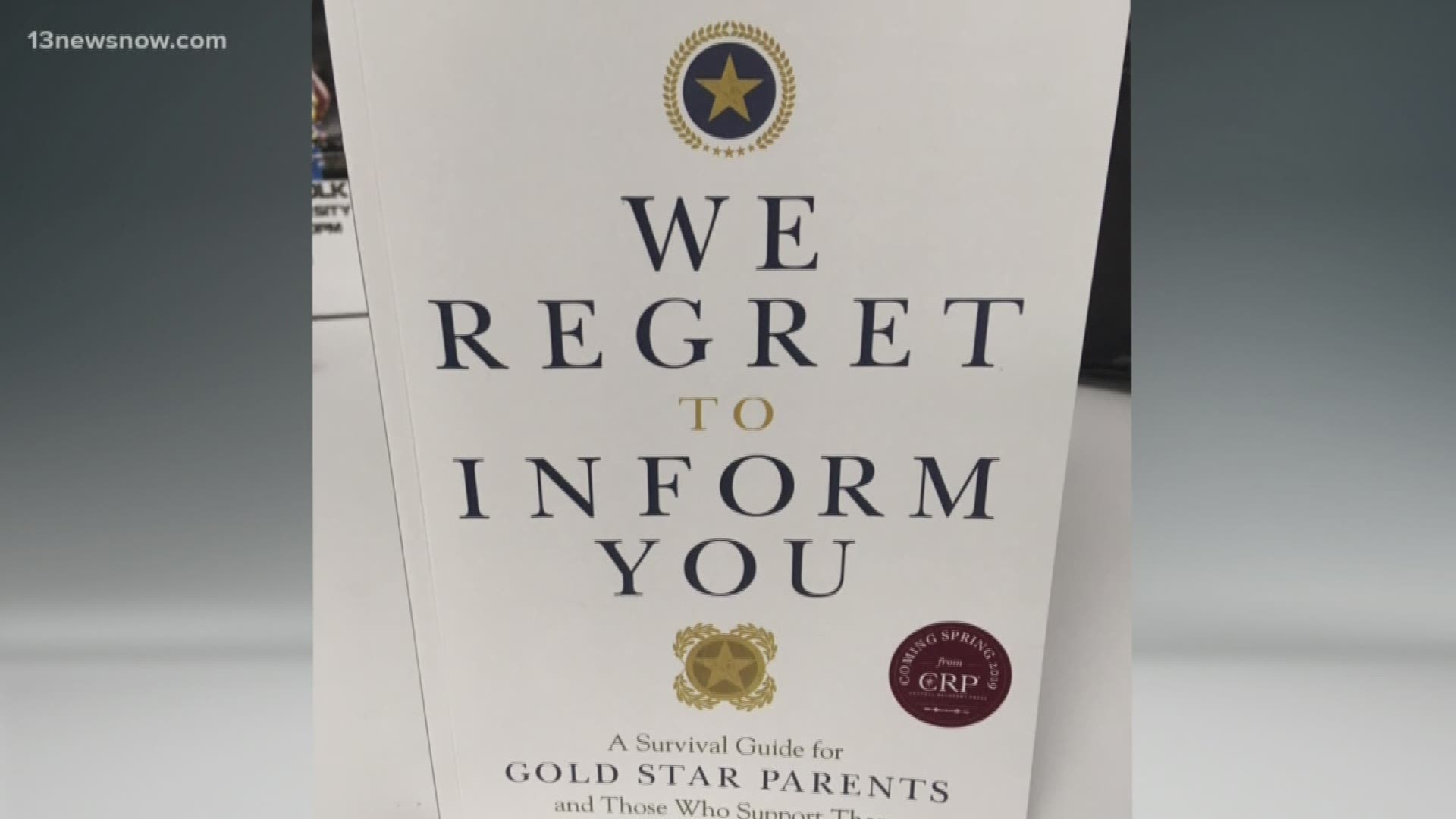

Prior to the Tax Cuts and Jobs Act of 2017, children receiving this benefit were taxed at the parent’s rate, but due to changes in the law, survivor benefits going to children are now treated as a trust or estate and can be taxed up to 37 percent. This change has affected Gold Star families, who previously paid an average of 12 to 15 percent in taxes on this survivor benefit and have now been forced to pay significantly more without adequate preparation.

“Gold Star families deserve our sympathy and gratitude, not an unfair tax increase thanks to a Congressional screw-up,” said the Senators. “We’re glad the Senate has decided to fix this mistake, and we hope the House will take action swiftly to ensure that Gold Star families aren’t hit with a tax hike.”

Companion legislation has been introduced by Rep. Elaine Luria (D-VA) in the House of Representatives, which now must vote to send the bill to the President’s desk for signature.