RICHMOND, Va. — Among the billions of dollars of newly allocated state funding through the latest budget, is a $10 million portion carved out for victims of mass casualty events.

The fund, housed within the Department of Criminal Justice Services, sets aside money for victims of mass violence events to help pay for out of pocket expenses not covered by insurance.

"It's grown and expanded and that’s a great thing. I wish we could’ve implemented it last year and come to the table, but having it now is a start," Delegate Kelly Convirs-Fowler told 13News Now Wednesday.

Convirs-Fowler, who's House of Delegates district encompasses portions of Virginia Beach and Chesapeake, introduced the legislative effort in the 2022 regular General Assembly session. The motion, later supported by Virginia Governor Glenn Youngkin in the form of his own proposed budget amendment last December, came months before the high profile shootings on the grounds of the University of Virginia and the Chesapeake Walmart mass shooting.

"We’ll look at it for a year and make sure we have standards in place, how we define victims of mass violence," she added.

Here are the details of the fund:

All revenues to the Fund, all funds appropriated to the Fund, and any gifts, donations, grants, bequests, and other funds received on its behalf shall be paid into the state treasury and credited to the Fund. Interest earned on moneys in the Fund shall remain in the Fund and be credited to it. Any moneys remaining in the Fund, including interest thereon, at the end of each fiscal year shall not revert to the general fund but shall remain in the Fund. Moneys in the fund shall be used solely to provide assistance to the victims of mass violence in Virginia, to include but not be limited to their out-of-pocket expenses not covered by insurance, and begin three years after the mass violence event and remain in perpetuity. Expenditures and disbursements from the Fund shall be made by the State Treasurer on warrants issued by the Comptroller upon written request signed by the Director, Department of Criminal Justice Services or his designee.

Absent from the budget is a separate request by the families of the 5/31 Virginia Beach mass shooting, who collectively requested $40 million to be used by the victim's immediate families as well as employees at the Municipal Complex that day.

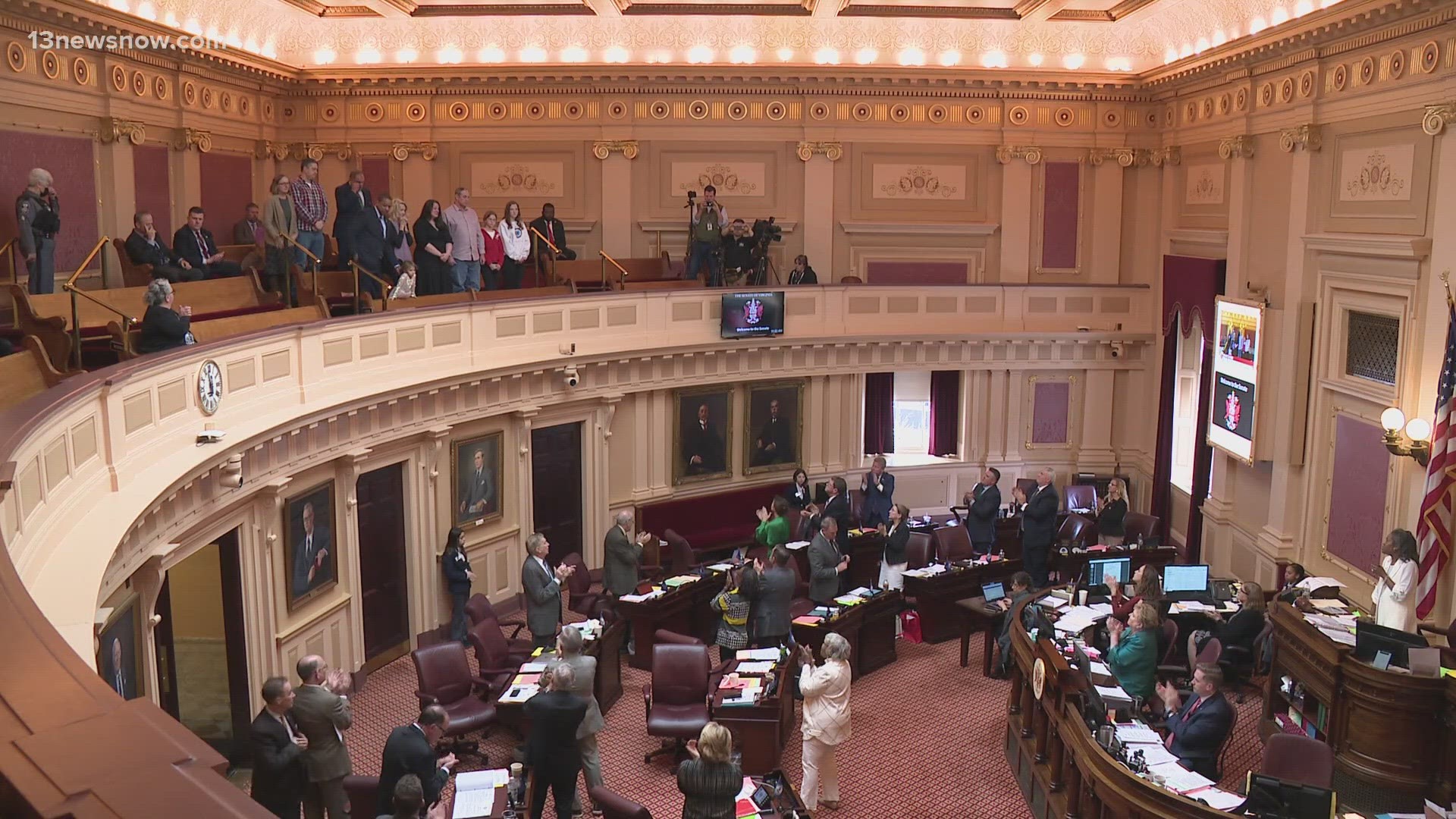

The families, along with former Lt. Gov Justin Fairfax, visited the Capital building in Richmond earlier this year to make the request in-person in front of Virginia lawmakers.

“I’m really pleased with the budget we have before us today. The negotiations have been very intense and very extended. But the outcome is both fair and balanced towards the priorities of both the House and the Senate,” said Democratic Sen. Janet Howell of Fairfax County, who co-chairs the Senate Finance and Appropriations Committee.

Howell was among a small group of negotiators holding closed-door budget talks since the Legislature's regular session ended without agreement on adjustments to the two-year state spending plan, which runs through mid-2024. The group announced the compromise two weeks ago but only rolled out the full bill last weekend.

The proposal includes about $1 billion in tax reductions, mostly through one-time tax rebates of $200 for individuals and $400 for joint filers. It also would increase the standard deduction, remove the age requirement for a military retiree tax benefit and reinstate a popular back-to-school sales tax holiday lawmakers forgot to renew. While the holiday typically takes place in August, it would instead be held this year in late October under the plan.

Tax policy changes were a key part of what turned into a six-month stalemate, as Youngkin and the GOP-controlled House of Delegates had argued for an additional $1 billion permanent cuts, including a reduction in the corporate tax rate. Democrats who control the state Senate argued that more reductions would be premature after negotiating $4 billion in tax relief last year. The rebates, which weren't initially included in either chamber's budget bill, were a compromise.

The legislation would boost K-12 education spending by about $650 million and fund behavioral health initiatives sought by Youngkin, including new crisis-receiving centers and crisis stabilization units. It includes funding for an extra 2% raise for state workers starting in December, and money for the state's share of a 2% raise for state-supported local employees, including teachers. The combination of tax cuts and increased spending is possible because the state had accumulated a multibillion-dollar surplus.

"While the process took longer than needed, more than $1 billion in tax relief is on the way to Virginia veterans, working families and businesses. Additionally, this collaborative effort ensured the funding of our shared priorities: investing in students and teachers, supporting our law enforcement community and transforming the way behavioral health care is delivered in the Commonwealth," reads a statement from Gov. Youngkin.

Because Virginia operates on a two-year budget cycle, with the full plan adopted in even years and tweaked in odd years, this year's delay in approving the legislation has not impacted state government services or payroll. But it has led to consternation from school districts, local governments and other interests impacted by the state's taxation and spending policies.

“This budget agreement prioritizes Virginia families, especially our veterans and our children, over the tax cuts that the Republicans wanted to give to big corporations,” House Democratic Leader Don Scott said.

House Appropriations Chairman Barry Knight said it was a “bipartisan, bicameral compromise" and retiring Republican Sen. Steve Newman called it “as fiscally responsible a bill as I've ever seen,” given its focus on one-time versus recurring spending.