NORFOLK, Va. — With tax season underway, many Americans are searching for ways to possibly owe less money or get more money back on their returns.

Those taxpayers may be in luck as there are some unusual ways to receive tax deductions this April.

Here's a breakdown of some little-known write-offs.

Over the years, the IRS has allowed some unusual tax deductions including cosmetic surgery and weight loss.

For example, the agency has previously allowed a woman to write off expenses related to her breast implants.

However, accountants warn that's usually not allowed unless you can prove the surgery is medically necessary.

If you joined a weight loss program you may be able to save money, if your doctor ordered you to lose weight for obesity.

While we all love our furry friends, we may not like the cost of those pets.

If you can prove your pet is for business reasons, you may be able to get a deduction.

If you own a service animal that counts as a medical expense.

Good news for service members — your pet could save you money if you moved your personal items to a new home since the IRS considers household pets as your personal property.

Tutors are also a tax deduction. They can count as a medical deduction if your child has a learning disability.

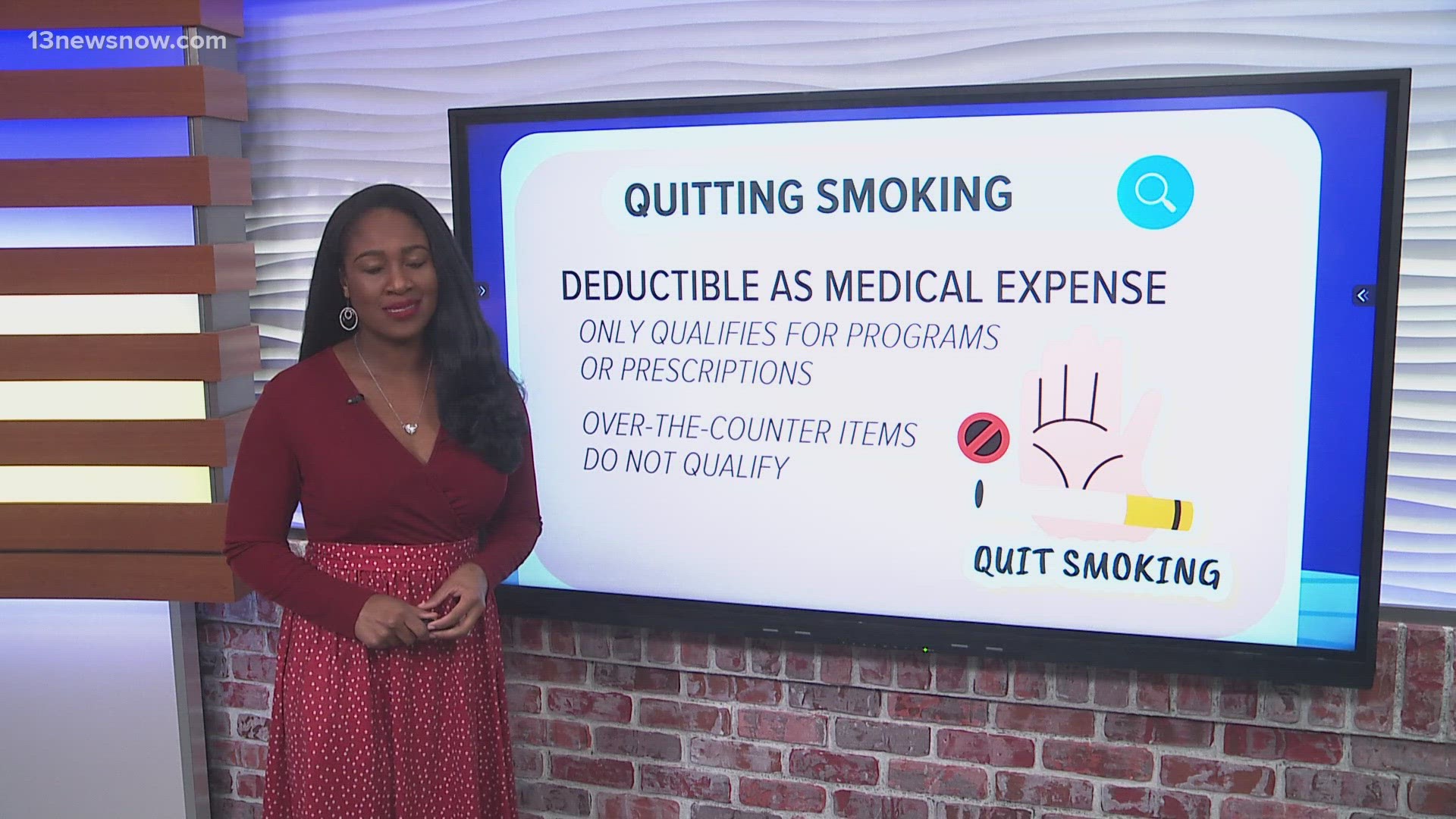

Finally, if you quit smoking you could save money while getting healthier.

The costs of programs or prescription patches are deductible but over-the-counter items are not.

While taxpayers like to push limits to save money, accountants recommend you consult with a professional before pursuing any unusual tax deductions.